JOINT MEDIA RELEASE

B2B COMMERCE AND OCBC BANK FACILITATE COUNTRY’S FIRST CROSS-BORDER B2B ELECTRONIC SETTLEMENT PLATFORM

Move aims to encourage local SMEs to participate actively at a global level

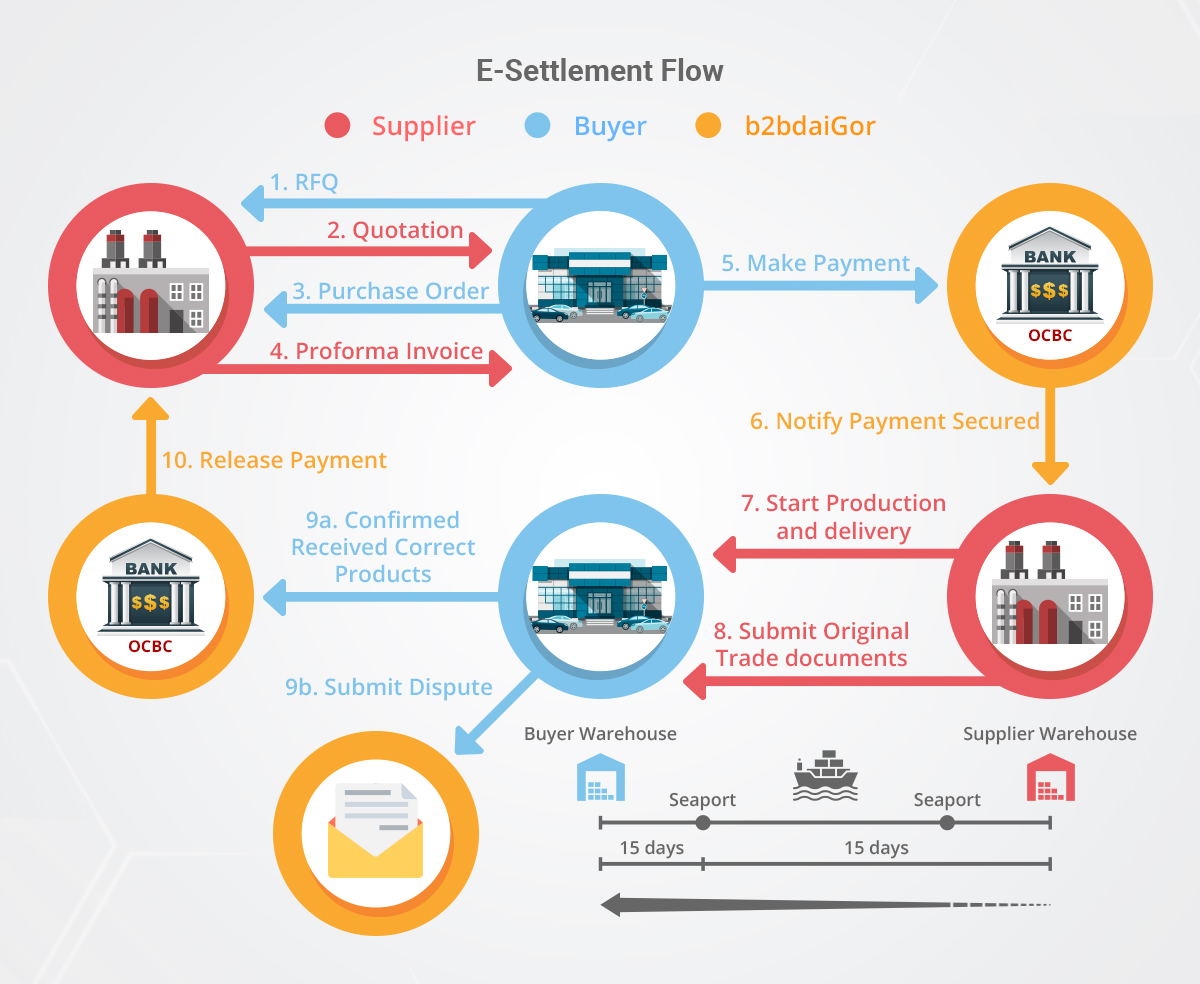

Kuala Lumpur, 25 March 2019 – B2B Commerce (M) Sdn Bhd (B2B Commerce) has become Malaysia’s first home-grown company to facilitate cross-border business-to-business (B2B) electronic trade settlements for SMEs thanks to a strategic partnership with OCBC Bank (Malaysia) Berhad (OCBC Bank).

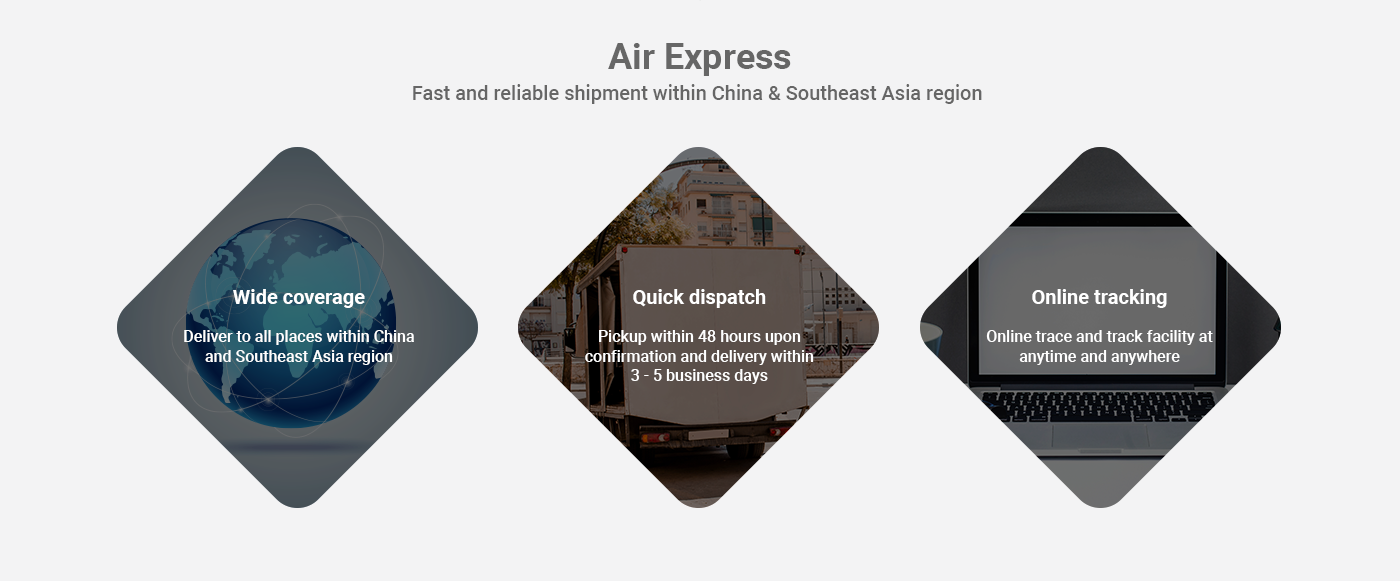

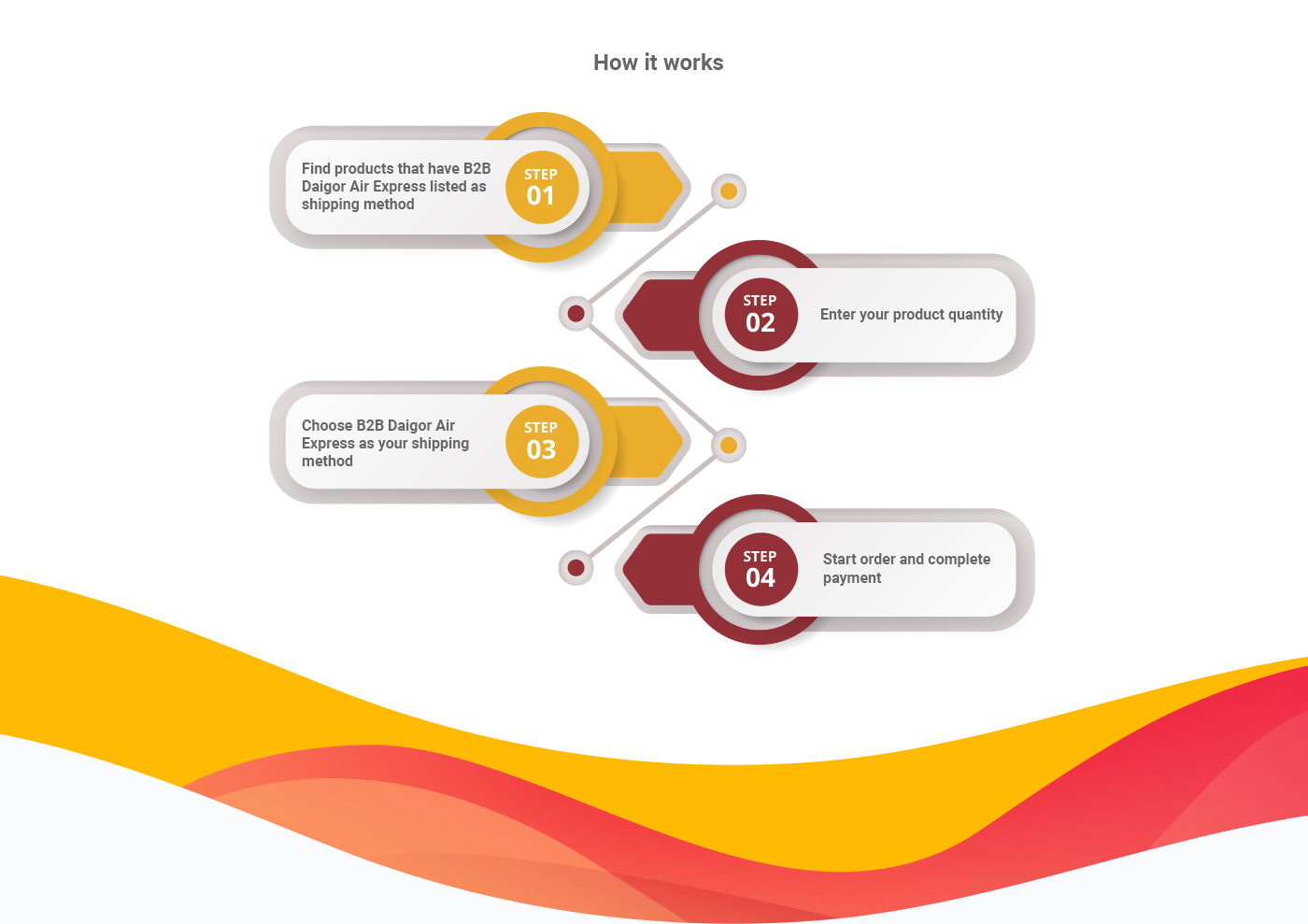

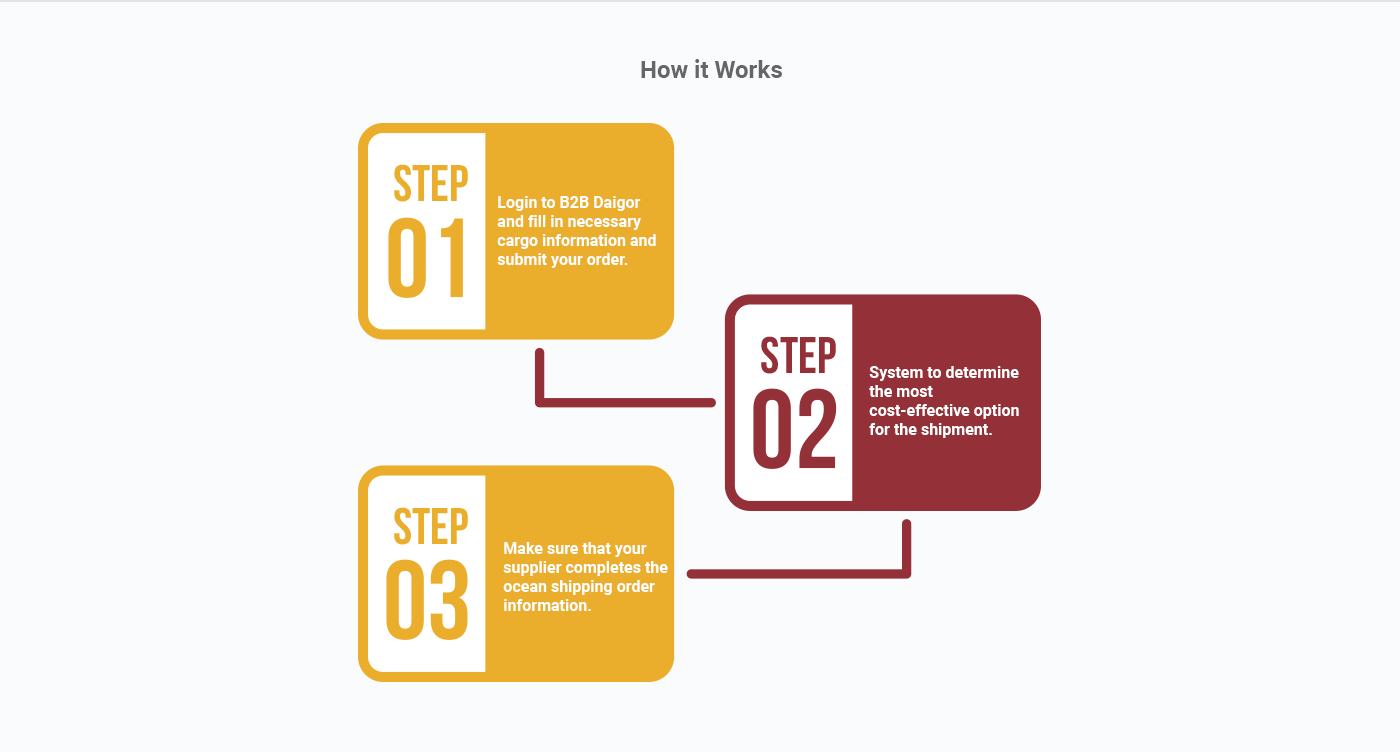

The move, featuring B2B Commerce’s new online platform B2B DaiGor (www.b2bdaigor.com), is expected to help SMEs reduce cost whilst minimising the hassle of cross-border transactions. It will benefit existing SMEs in the import export market and those who are ready to take on the global market.

While B2B DaiGor allows SMEs to expand their market reach globally and manage their transactions digitally, OCBC Bank helps with the settlement dimensions so the ensuing global financial transactions run smoothly and seamlessly.

According to Dr Lee Thean Seong, B2B Commerce Director & CEO the company’s studies have shown that, without the financial muscle, it is hard for smaller brands to fight on a level field with branded products in existing B2B e-marketplaces.

“The services available do not help the lesser-known brands to be successful. Our strategy is to concentrate on the lesser-known brands, specifically those from the fast moving consumer goods (FMCG) industry initially. We will help to bridge the gap for them to the online and offline markets in South East Asia and China. In our existing ecosystem we are already serving more than 12,000 FMCG suppliers in these regions. We are currently working on getting these suppliers to be part of the B2B DaiGor community for the export and import business.

“In light of this, we are thankful for the partnership with OCBC Bank which will ensure the financial transactions are carried out smoothly and seamlessly,” he said .

With 19 years of business operations under its belt, B2B Commerce has a regional presence in Malaysia, Indonesia, Cambodia and Vietnam as well as joint-ventures in China and Thailand.

Its existing services include efficient electronic trade documents exchange, data analytics to help customers achieve supply chain efficiency, peer-to-peer financing services through its subsidiary B2B FinPal Sdn Bhd as well as domestic logistics distribution services through Asia Commerce Logistics Sdn Bhd(ACL), its joint venture company with Hercules Logistics ShenZhen, China.

Dr Lee added that the benefits of the B2BC business model includes increased sales channels for Malaysian SME exporters in line with government initiatives to grow SME companies through the export business, and positioning of Malaysia as a B2B marketplace hub.

OCBC Bank Head of Global Transaction Banking Ms Chong Lee Ying said being the exclusive transaction enabler for the home-grown first-of-its-kind online platform was a privilege and the Bank is looking forward to helping SMEs tap into the opportunities out there and meet their ongoing digital banking needs.

“We have in recent times explored several digital initiatives including rolling out the country’s first mobile business banking app. Today’s strategic partnership with B2BC is a significant one for helping our SME customers meet their needs at a global level. This will help boost the SME segment and assist local SMEs in their bid to reach out more significantly through the online export business,” she said.

For further information, the public and SMEs may visit www.b2bdaigor.com.